Everyone hates thinking about April 15th–but not as much as they hate forgetting about it. If you missed the deadline for filing a tax return and are getting a refund, there is no penalty, given you file within three years. If you file after that, you will not receive your tax refund.

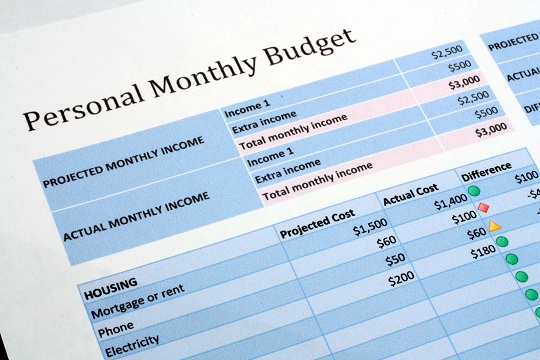

If you do owe additional taxes, you need to e-file as soon as possible. The penalty for late filing (5% of your owed taxes for every month it is late) is worse than the penalty for late payment (.5% of your owed taxes for every month it is late). The maximum charges accumulated for both penalties is capped at 25%. So suppose you file a late tax return in April and make your payment of $1,000. The late filing charge would be $50 whereas the late payment charge would only be $5.

There are certain situations that are exempt from penalties and given a two month extension. This includes:

1. Being out of the country (the U.S. or Puerto Rico) for your main place of work or military or naval service. You can receive and additional four months by filing an extension and paying taxes you owe.

2. Not receiving your Form W-2.

3. Receiving a Form W-2 you believe is incorrect.

4. Being self-employed.

Not Filing a Tax Return At All

If you fail to file a tax return, the IRS will send you a reminder to do so. If three years have past since the deadline, you forfeit your tax refund. The IRS will eventually help you file a substitute return based on other sources; it will not include exemptions or expenses you may be entitled to. Continued non-compliance can lead to other penalties and even criminal prosecution.

TalkLocal can connect you with local tax preparation services to help you file your taxes as soon as possible. With TalkLocal, you don’t have to flip through the yellow pages and call unresponsive businesses. TalkLocal matches you with up to three companies in minutes because time is money–especially during tax season.