Preparing personal budget information is not terribly exciting or fun. In fact, it can be downright depressing when you begin to delve into your monthly spending habits. However, if you are financially strapped and want to save money, a budget is the only way to go.

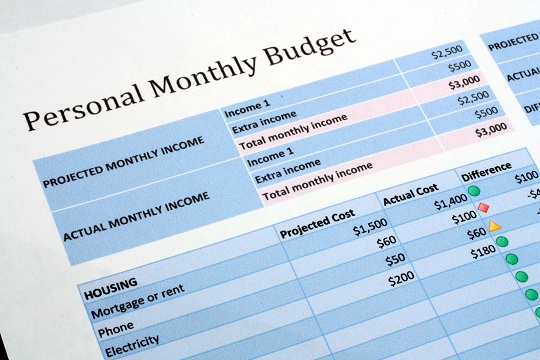

Creating a budget is easy. You simply need to keep detailed records of the money you spend and earn on a monthly basis. Your budget will highlight areas of unnecessary spending, so you can cut back on things you don’t need.

The following steps will put you on the path to financial stability:

1. Make note of every source of income. You may have two jobs and your spouse another. Document the net amount from your paycheck(s). If you have a job where your monthly income varies – whether from waiting tables, freelance work, or commission – take a monthly average based on your previous year’s income after taxes.

2. List your monthly expenses. Write down each expense that occurs on a monthly basis (in other words, everything you purchase and every bill you pay). Your checkbook register is a good place to find this information (click here to learn how to balance a checkbook).

3. Divide your expenses into fixed and variable. Take your master list of expenses and break each item down into the ones that remain relatively constant and those that vary from month to month. Fixed expenses include items like rent, car payment, cable, Internet, and trash service. Variable expenses will be things like gasoline, groceries, clothing, and pet care.

4. Come up with separate totals for monthly income and monthly expenses. If your expenses equal or exceed your income, you are in serious need of budgetary adjustments.

5. Reduce your expenses. If you feel confident that your list of monthly expenses is accurate, your first order of business is to cut unnecessary spending. Start by reducing expenditures on non-essential items like eating out, dry cleaning, and gifts. Even small changes like this will bring you closer in line with your income.

6. Revisit your budget every month. You may need to make slight adjustments to your budget throughout the year. For instance, you may have failed to allocate enough for groceries. Increase your grocery budget by reducing another variable expense such as entertainment.

Creating objectives and staying on a budget may be painful at times, but you should always keep your long-term financial success in mind. Whether your plan is to pay off credit card debt or create a comfortable nest egg, never lose sight of your goals!

If you are still struggling with your budget, check out TalkLocal – this free service will connect you with up to three accountants in your area who specialize in personal finance. You will be connected in minutes with a local professional who is available when you are.